Account opening experience

Product Designer, Jan 2021 - Oct 2021

During my time at Mobiquity, I worked with BPI (Bank of the Philippine Islands) on the redesign of their mobile banking app. BPI is one of the oldest and largest banks in the Philippines, has been operating for nearly 174 years with over 12 millions clients. My focus was on reimagining the new account opening and onboarding journey, a key part of BPI’s broader rebrand and app relaunch.

Roles and responsibilities

As part of the design team for BPI’s rebranded app, I collaborated with the principal and senior designer to define the new vision for the platform. I led the onboarding project with support from the principal designer, working closely with BPI teams in the Philippines to gather requirements, test concepts, and share weekly progress. I also collaborated with the BI team in India to integrate data-driven insights. During implementation, I partnered with engineers to ensure design accuracy and conducted remote testing sessions to validate the proof of concept.

Defining the problem

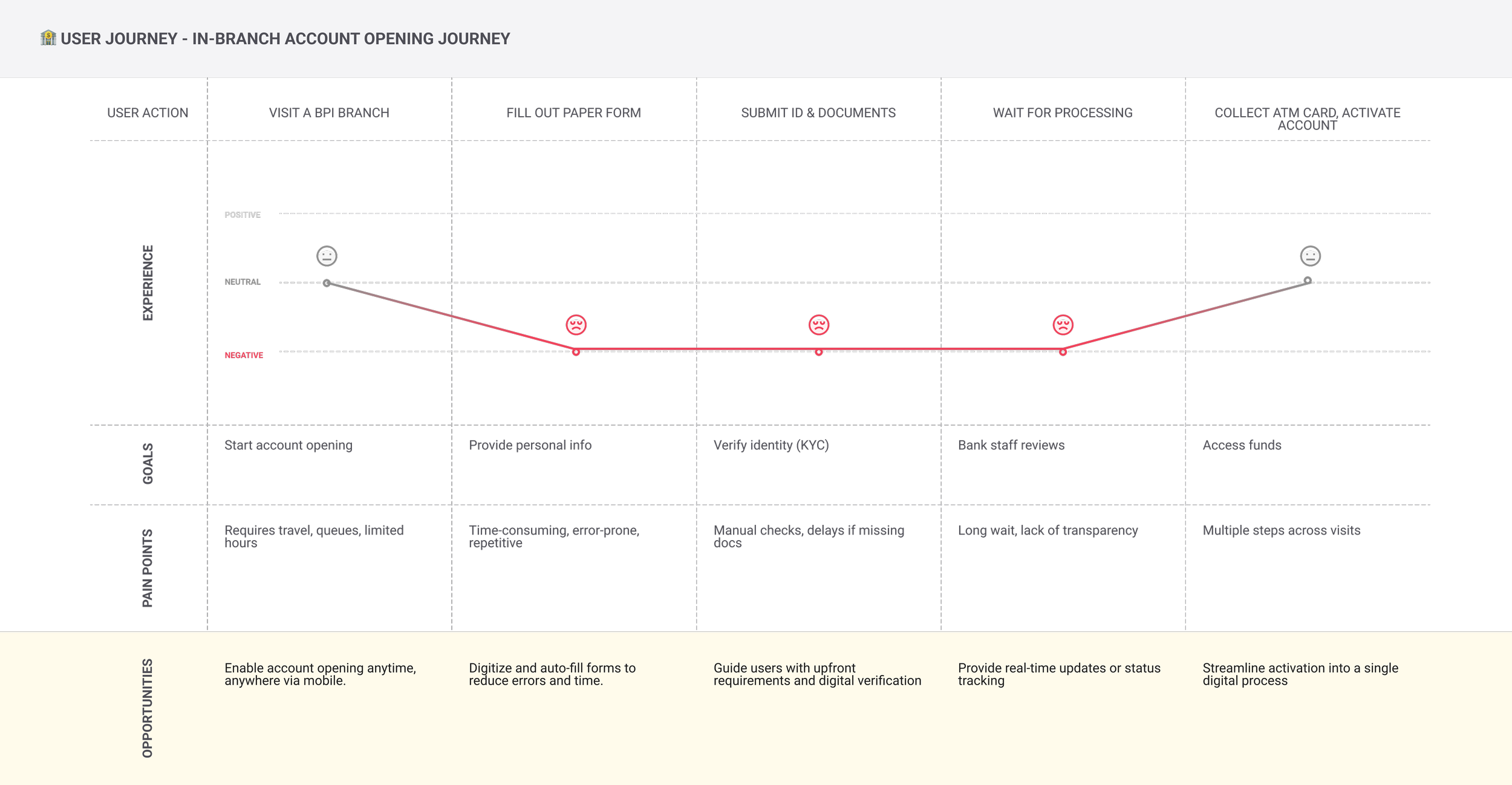

Limited account opening options: BPI only offered in‑branch account opening, while competitors had already moved online

Inconvenient customer experience: Customers needed to visit a branch multiple times, often taking weeks to complete the process

Outdated app: The digital experience lagged behind modern banking standards

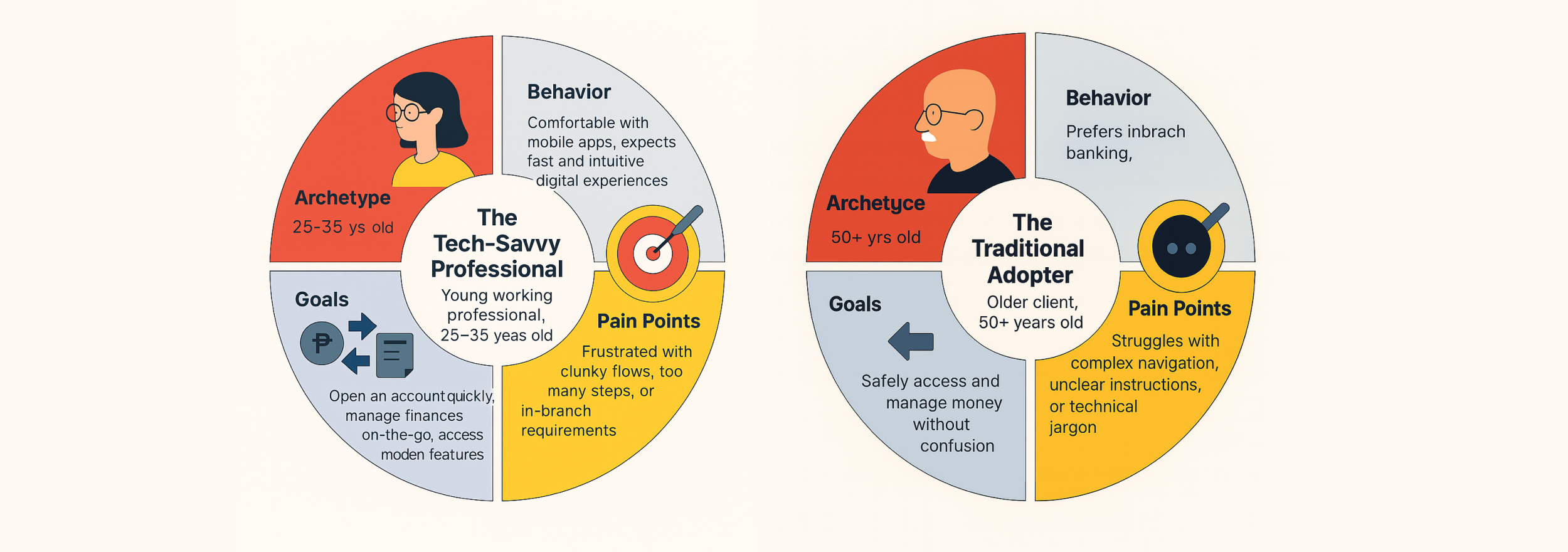

Our users

BPI’s users represent a broad spectrum of Filipinos, from first‑time account holders to long‑time clients transitioning to digital banking. Many are mobile‑savvy young professionals seeking convenience and speed, while others are traditional customers adapting to mobile for the first time. They value trust, security, and clarity when handling finances, and often face friction with lengthy in‑branch processes. For this reason, the onboarding experience had to be designed to be as clear, seamless, and accessible as possible, ensuring trust and ease of use for both first‑time digital adopters and experienced mobile users alike.

Research & discovery

Business requirements & User insights

Collaborated closely with BPI teams to align business goals with user needs

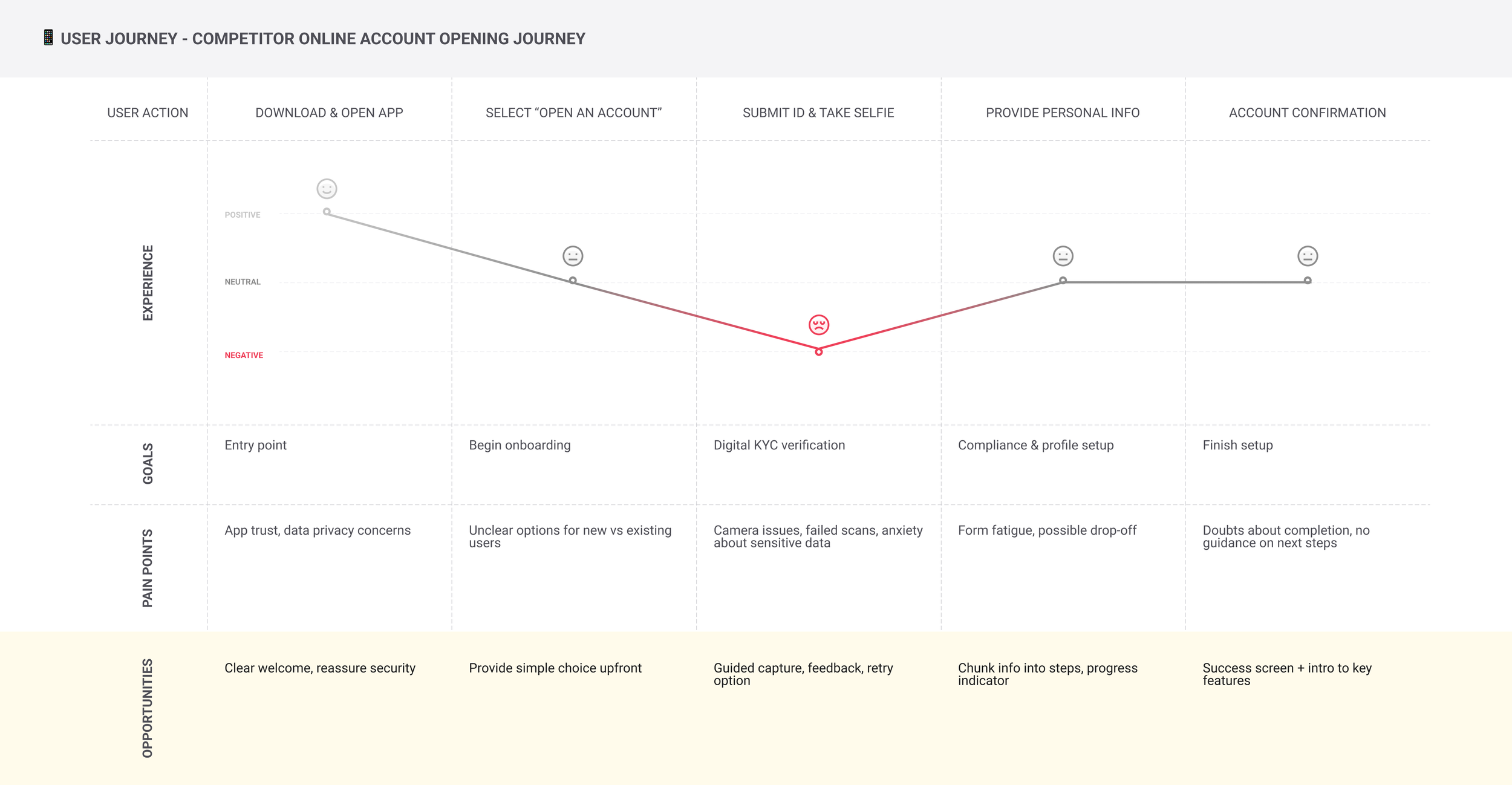

Competitor analysis

Reviewed how competitors deliver digital banking experiences

Benchmarked app design, customer journeys, and global best practices

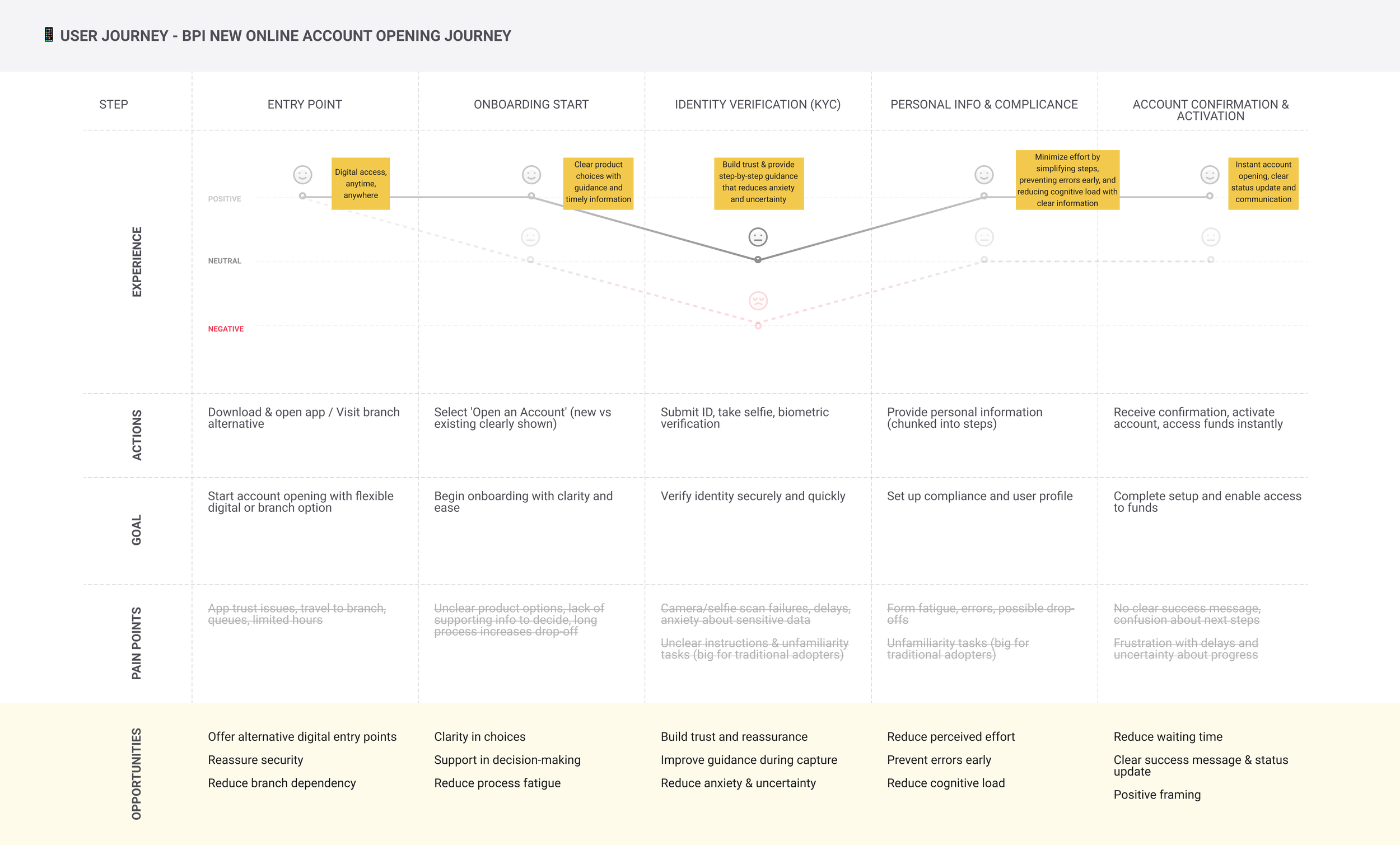

On & Offline User journey

Mapped end‑to‑end journeys (branch + online)

Identified pain points, drop‑offs, and opportunities for improvement

Weekly session

Shared findings and refined approach weekly

Aligned next steps with client to ensure clarity and momentum

Challenges: from both on & offline account opening experience

1. Confusing onboarding flow 😵💫

No clear guidance or process

Many users, especially traditional adopters, felt lost

2. Low trust in digital sign up process 🤔

ID capture and verification steps created anxiety

Multiple ID requirements increased frustration

3. Lack of timely support 🙇♂️

Little to no in‑flow assistance when errors occurred

Users struggled to make decisions without help

4. Time-consuming process ⏱️

Account opening required multiple steps and touchpoints

Both in‑branch and online processes were lengthy

Solution

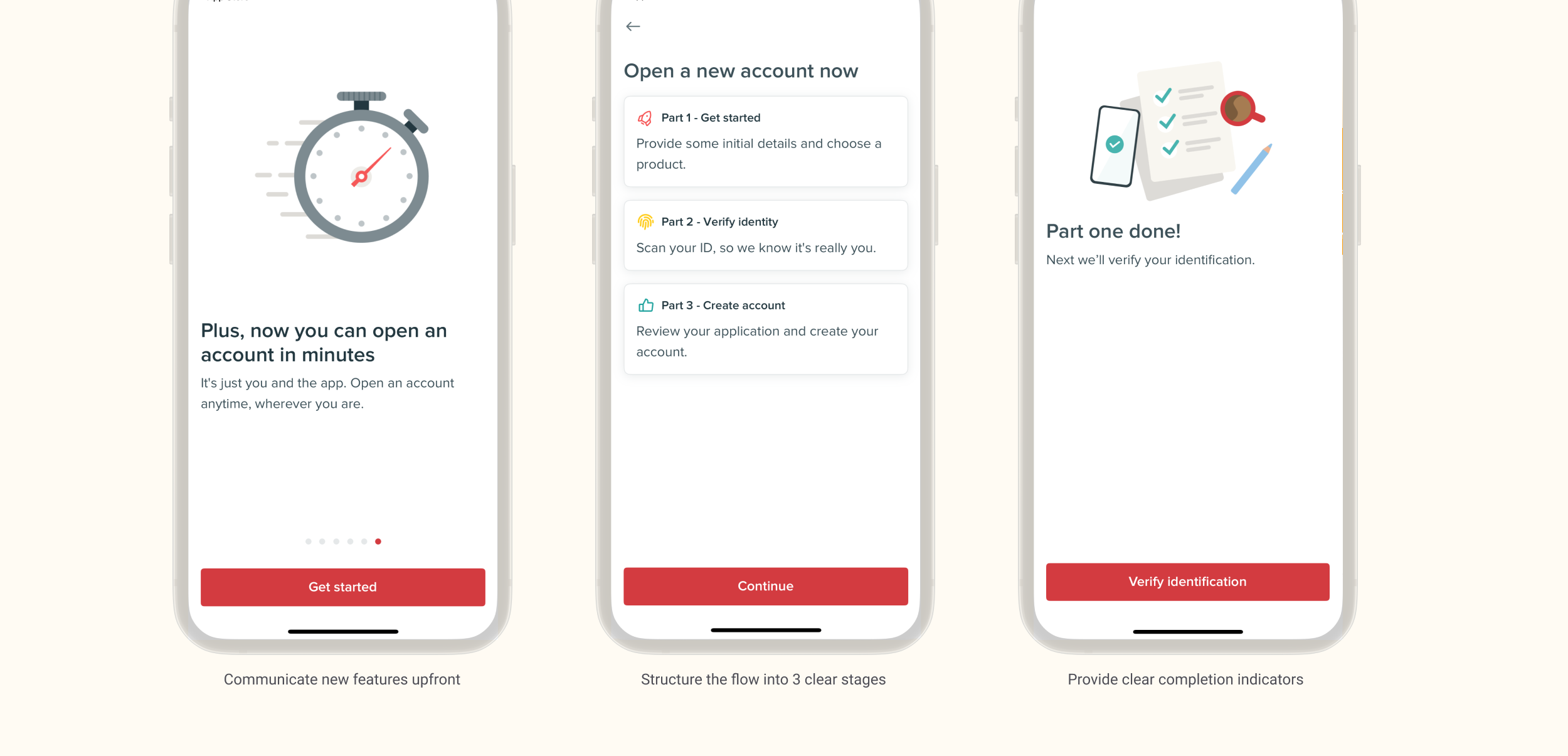

Simplified account creation flow

A 3-step process that can be done under 5 minutes

Maximise the clarity

Every step is transparent, intuitive and informative users know exactly what to do and what to expect

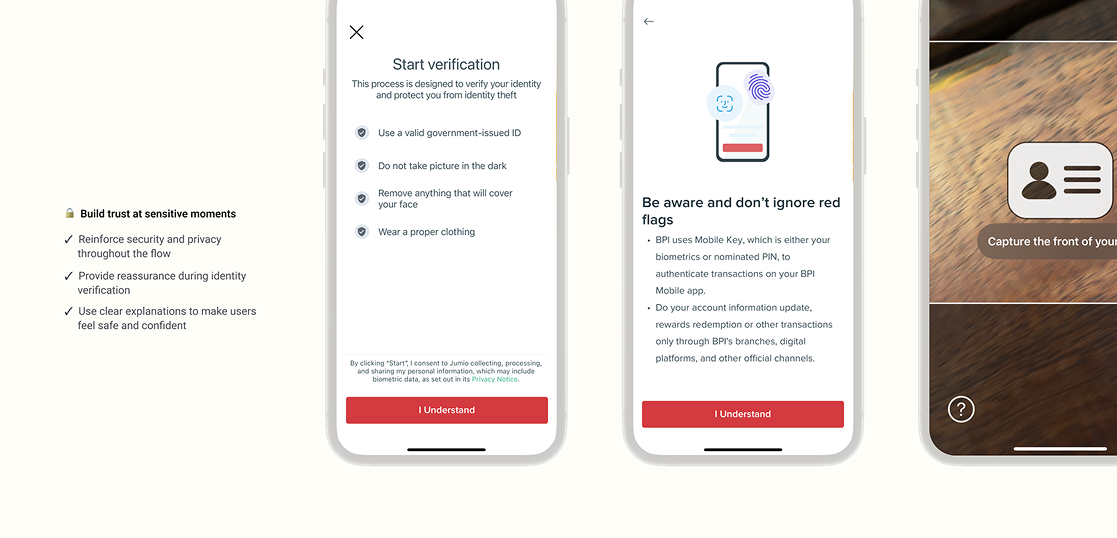

Build trust at sensitive moments

Reinforce security and privacy throughout, especially during identity verification, to make users feel safe and confident.

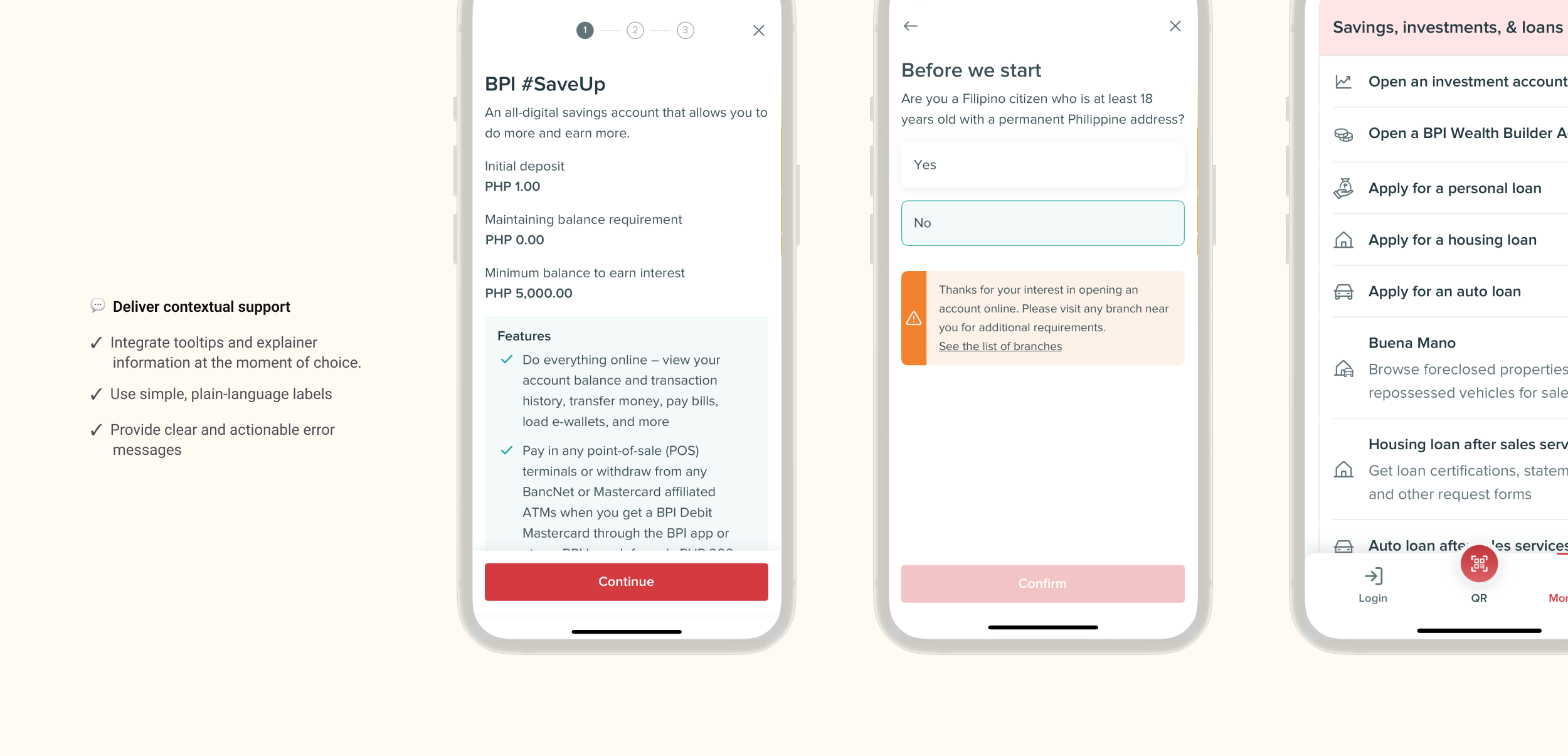

Deliver contextual support

When users need it ensuring they have what they need when they make decision and troubleshooting at their fingertips

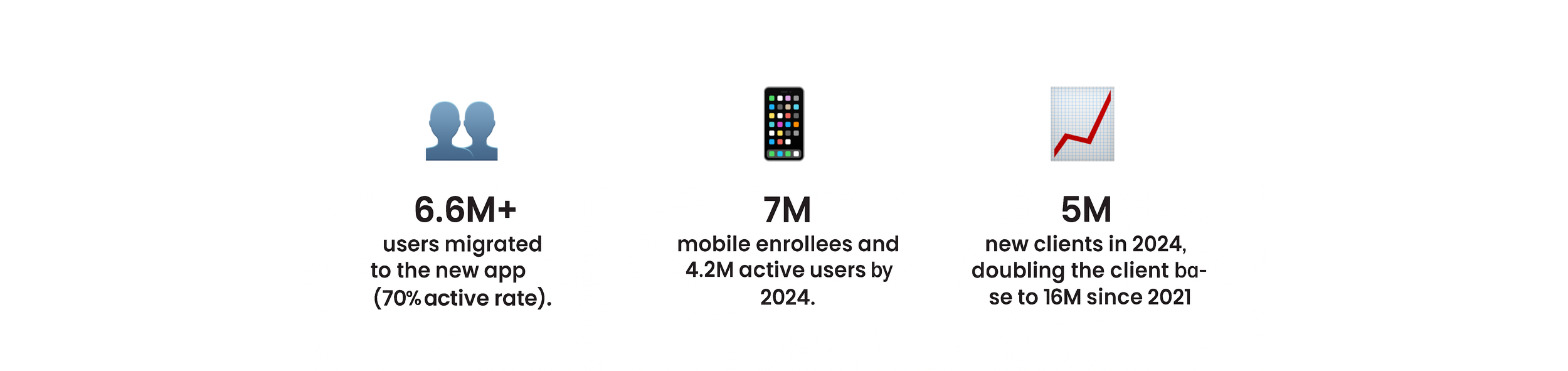

Impact

The ability to open an account in under 5 minutes became a key driver of growth.

Takeaways

One of my biggest learnings from this project was the importance of truly being the user’s voice. Early on, I found myself bridging the gap between users and the business, persuading BPI to embrace user testing despite initial hesitation. Once testing became part of their regular workflow, it opened doors to more informed, user-driven decisions.

Clear and consistent communication proved critical, especially in a global banking environment where approvals could take months. Detailed documentation kept everyone aligned across time zones and was invaluable when collaborating with developers in different countries.

I also learned how easily prior experience can create blind spots, every industry comes with its own set of challenges. In finance, trust and security are just as important as usability, which reinforced the need to deeply understand the sector and its users rather than relying on assumptions from past projects.